Ethereum ETF One Year Ago: From Cold to Hot, the Confidence of Institutions Behind the Flow of Funds Changes

Three months ago—when capital outflows from Ethereum ETFs were significant, market interest was low, and yield advantages were lacking—even the most fervent Ethereum supporters would have considered talk of a one-year anniversary for Ethereum ETFs on U.S. exchanges to be pure fantasy.

But today, Ethereum ETFs are enjoying their time in the spotlight: it’s now been a full year since trading began on July 23, 2024.

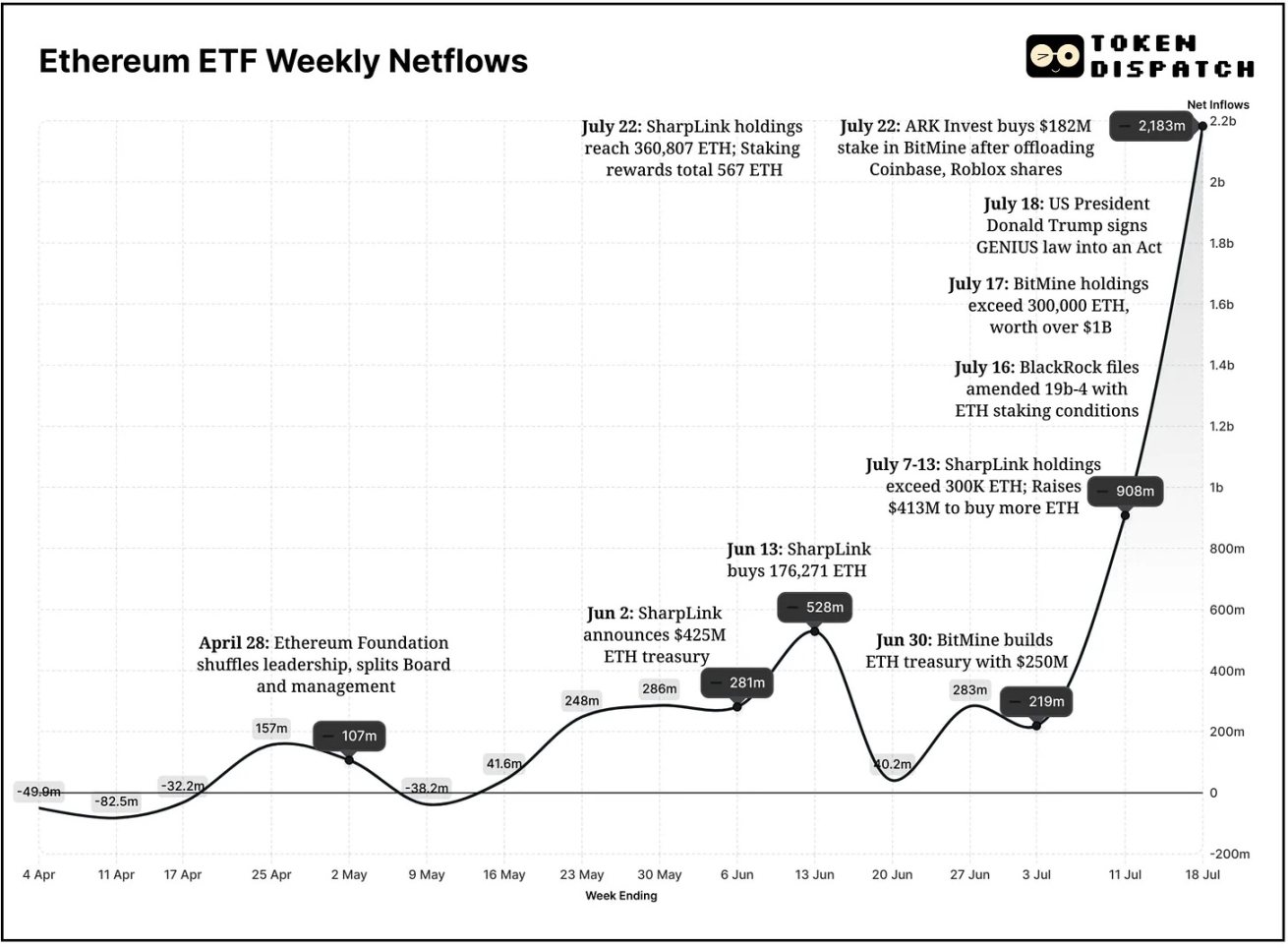

In June 2025, Ethereum ETFs logged their best monthly performance on record, attracting over $3.5 billion in net inflows—a 70% surge from the previous peak of $2.08 billion in December 2024. July’s inflow momentum has been even stronger, with more than $3 billion added so far and the possibility to outperform June. The two weeks ending July 18 marked the best two-week stretch in net inflow history; and for the first time ever, the ETF has gone ten straight weeks without any net outflows in its 52-week lifespan.

The chart below’s “hockey stick” growth illustrates this explosive trend.

Yet, the path for Ethereum ETFs hasn’t always been smooth.

In May 2024, U.S. regulators approved Ethereum ETFs, with trading officially beginning on July 23. Initial market reactions were mixed. Bitcoin ETFs had already captured all the attention earlier in the year, so Ethereum’s launch seemed underwhelming: price performance lagged, interest faded, and no significant capital entered in the early stage.

In fact, early fund flows even showed net outflows.

During the first 39 weeks of trading, Ethereum ETFs posted net inflows in just 15 weeks; by contrast, 13 of the last 14 weeks have seen net inflows, highlighting just how dramatically sentiment has shifted over the past three months.

By July 21, 2025, total assets under management (AUM) for all U.S. Ethereum ETFs had surpassed $19 billion—doubling from about $9.6 billion only two months prior.

Institutional interest in Ethereum is also heating up, not just through ETFs but via “Ethereum reserve assets.”

On June 2, 2025, SharpLink Gaming became the first U.S. public company to include Ethereum in its strategic reserves. While much of the crypto world was still watching which public companies would add Bitcoin to their balance sheets, Joe Lubin brought Ethereum to the “reserve asset party.”

As Ethereum co-founder and Consensys founder and CEO, Lubin joined SharpLink Gaming’s board as chairman and led the company’s $425 million strategic Ethereum reserve initiative.

With this reserve strategy, SharpLink has become the world’s largest corporate Ethereum holder, amassing 360,807 ETH—worth over $1.3 billion at current prices. The company also raised another $413 million, and through staking its ETH has earned a total of 567 ETH in rewards.

Additionally, SharpLink filed a supplemental prospectus with the SEC, seeking to boost its authorized common stock offering from $1 billion to $5 billion.

But a new player has emerged to challenge for dominance in Ethereum reserve assets.

Bitcoin mining company BitMine Immersion has also bet big on Ethereum, holding more than 300,000 ETH—valued at over $1 billion. Chairman Tom Lee, a Wall Street veteran, has even greater ambitions:

“We’re steadily working toward our goal—to acquire and stake 5% of Ethereum’s total supply.” SharpLink and BitMine’s combined ETH holdings now exceed those of the Ethereum Foundation.

All in all, capital flows into Ethereum reserve asset companies and ETFs reflect institutions’ growing conviction in Ethereum as foundational infrastructure—and that confidence is only gaining momentum.

Recently, ARK Invest, led by Cathie Wood, trimmed its positions in Coinbase and Roblox while significantly increasing investments in BitMine Immersion with $182 million in fresh capital. Previously, ARK’s Ethereum exposure was minimal, but after reshuffling its three flagship ETFs, it has allocated 1.5% of its portfolio to BitMine.

Billionaire Peter Thiel also owns 9.1% of the company.

A new company, Ether Machine—created through the merger of existing businesses—plans to build a publicly traded platform giving institutional investors high-level access to Ethereum infrastructure and staking yields.

Ether Machine was co-founded by Andrew Keys, former Consensys board member and executive, and David Merin, former Consensys executive and current Ether Machine CEO. After the merger, Ether Machine aims to list on Nasdaq, holding more than 400,000 ETH worth over $1.5 billion.

What changed in recent months? Leadership changes at the Ethereum Foundation could be a catalyst.

At the end of April 2025, the Ethereum Foundation announced a leadership restructuring, separating the board and executive management. The new team set out three key priorities: scaling Ethereum’s base layer, optimizing Layer 2 rollups, and enhancing user experience.

Ethereum’s utility and yield potential have also made it an increasingly attractive investment choice.

Currently, no U.S. ETF offers staking rewards, as the SEC has yet to approve such features. If staking is eventually allowed for Ethereum ETFs, ETH could become the “digital bond” in institutional portfolios.

Staking-enabled ETFs might offer 3%–5% native yield. With $19.6 billion in current ETF-held Ethereum, issuers stand to earn over $750 million in annual staking revenue at an average 4% yield.

BlackRock is already exploring staking integration; in its 19b-4 amendment, the firm states that staking is “a potential future feature subject to regulatory approval.” The market is watching closely.

Experts forecast that Ethereum ETF staking could win approval as soon as Q4 this year.

For many investors, staking could be the difference between “light exposure” and “deep engagement.” Passive yield—earned through regulated investment vehicles—could bring in pensions, endowments, and sovereign wealth funds.

According to a report by market maker and trading firm Wintermute released at the time of last year’s Ethereum ETF launch, the lack of staking was a major drawback that could “diminish Ethereum’s appeal as an ETF vehicle.”

If the macro environment shifts—such as rate cuts, stable inflation, or a hunt for higher returns—Ethereum will become a formidable contender: it combines scarcity from its deflationary supply, yield from staking, and accessible exposure via ETFs and custodians.

Ethereum’s price has increasingly moved in sync with institutional activity. If prices break higher, it could spur fresh optimism and further inflows. After years of relative quiet, Ethereum’s ongoing evolution is being welcomed by both retail and institutional investors.

Over the past two weeks, Ethereum’s price has soared more than 50% to reach a 2025 high; over three months, it’s up 150% in total.

When an ETF issues new shares, it must buy ETH, tightening supply in the process. As circulating ETH shrinks, upward price pressure builds.

Ethereum reserve asset companies are expected to remain committed holders. Registered investment advisors, wealth managers, and public companies rarely chase short-term returns or engage in panic selling.

Reserve asset builders are positioning ETH as programmable collateral—a yield-generating, stable, secure asset.

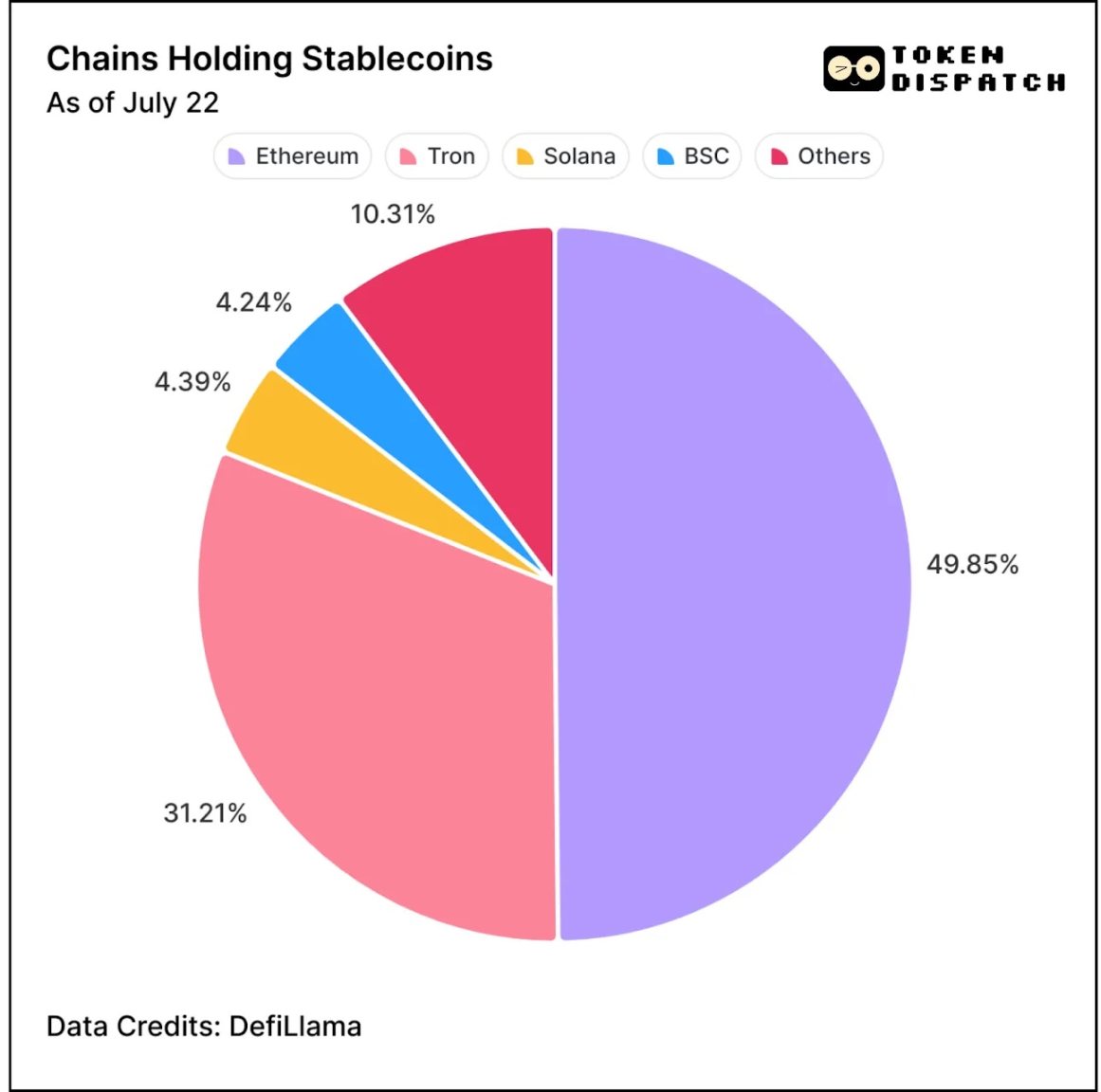

The macro backdrop is also positive: the recent passage of the GENIUS Act legalizes stablecoins as digital cash. With a 50% market share, Ethereum—the leading network—is set to benefit most.

What’s next?

Once the SEC greenlights ETF staking features, look for an acceleration in institutional demand. More companies may establish Ethereum reserves for staking purposes, and asset management giants like BlackRock are likely to increase allocation to Ethereum.

Traditional investors may soon realize that Ethereum now has two robust channels for liquidity—ETFs and reserve assets. These approaches both lock up supply and extend Ethereum’s influence into the broader economy.

Observers who directly compare Bitcoin and Ethereum as reserve assets and ETF vehicles often overlook the fundamental differences:

Bitcoin is primarily a store of value—a “digital gold” for macro strategies. Ethereum, however, is prized for its real-world utility. Fund issuers and reserve asset builders are buying ETH for its added value: staking rewards, infrastructure capabilities, and its role as a programmable platform for financial applications.

Disclaimer:

- This article is republished from [Foresight News], with copyright belonging to the original author [Prathik Desai]. For republishing objections, please contact the Gate Learn Team and we will take prompt action in line with our procedures.

- Disclaimer: All views and opinions expressed are those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn Team, and may not be copied, distributed, or plagiarized without referencing Gate.

Related Articles

What Is Ethereum 2.0? Understanding The Merge

Reflections on Ethereum Governance Following the 3074 Saga

An Introduction to ERC-20 Tokens

What is Neiro? All You Need to Know About NEIROETH in 2025

Our Across Thesis