BlockchainPioneer

In the digital asset market, the experience of an investor is thought-provoking. He had incurred losses for three consecutive years, with debts reaching 8 million. However, through relentless effort and strategic adjustments, he achieved an astonishing turnaround in the following seven years, ultimately reaching the realm of financial freedom. Currently, his monthly income has reached seven figures, and his annual income has even surpassed eight figures.

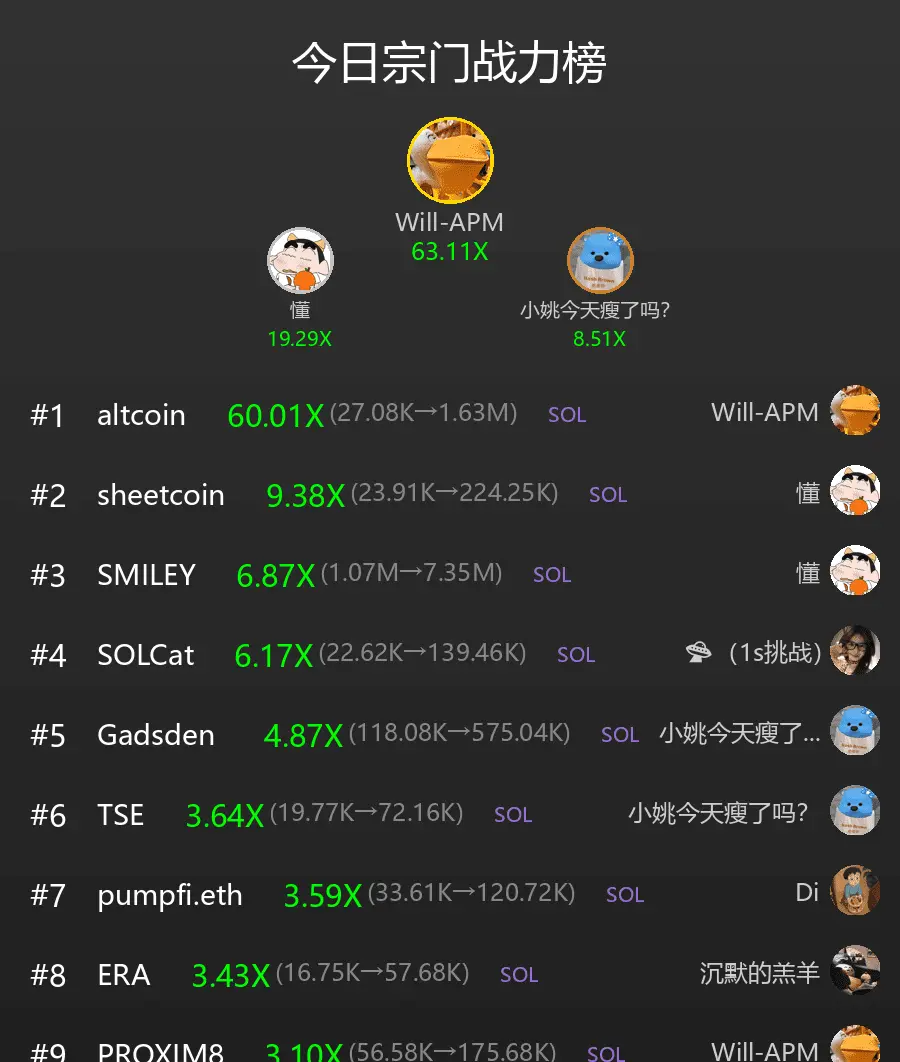

The investor shared his successful strategy, calling it the '10x Rolling Position Rule'. This method claims to grow a principal of 30,000 to

View OriginalThe investor shared his successful strategy, calling it the '10x Rolling Position Rule'. This method claims to grow a principal of 30,000 to