Many people believe that growth must be achieved through personal experience, but in reality, we can adopt a wiser approach to promote personal development.

True wisdom is not only reflected in the ability to learn from one's own experiences but also in the ability to learn from the experiences of others. This approach can help us avoid unnecessary mistakes while accelerating our growth process.

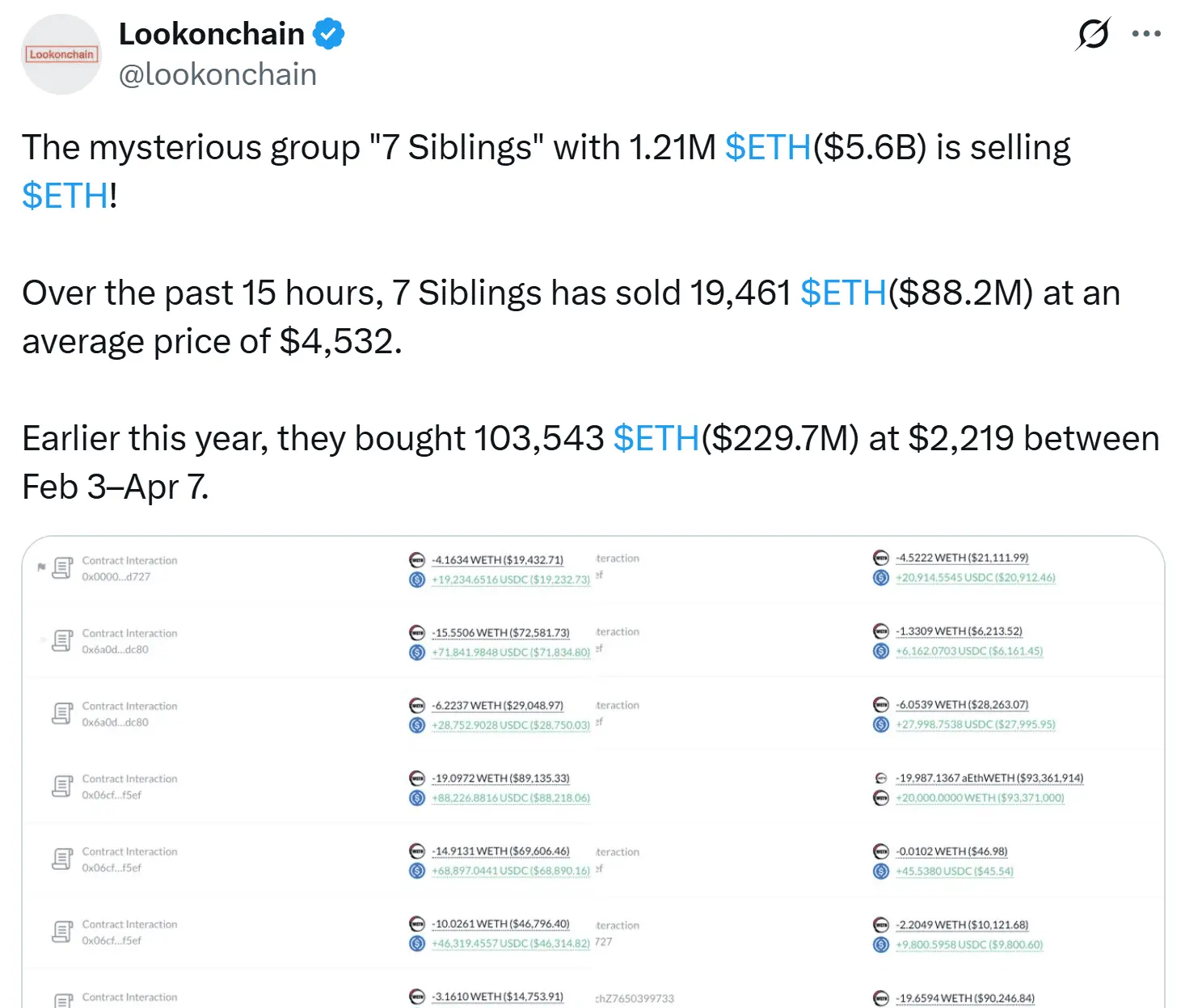

Personal experiences can be seen as an investment in learning. However, this investment can sometimes be costly, including the consumption of time, energy, and even emotions. Therefore, we need to care

View OriginalTrue wisdom is not only reflected in the ability to learn from one's own experiences but also in the ability to learn from the experiences of others. This approach can help us avoid unnecessary mistakes while accelerating our growth process.

Personal experiences can be seen as an investment in learning. However, this investment can sometimes be costly, including the consumption of time, energy, and even emotions. Therefore, we need to care