GateUser-aa7df71e

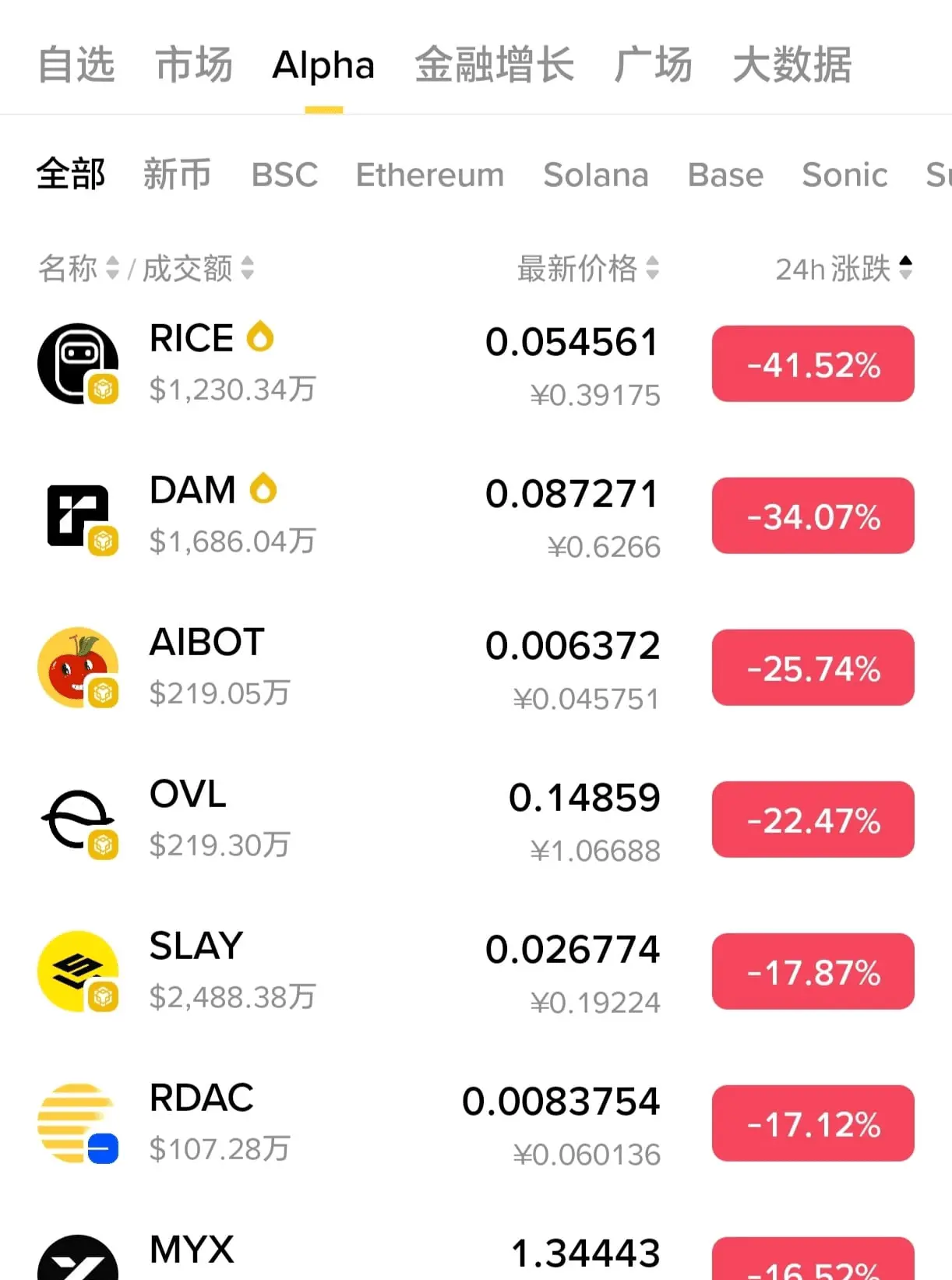

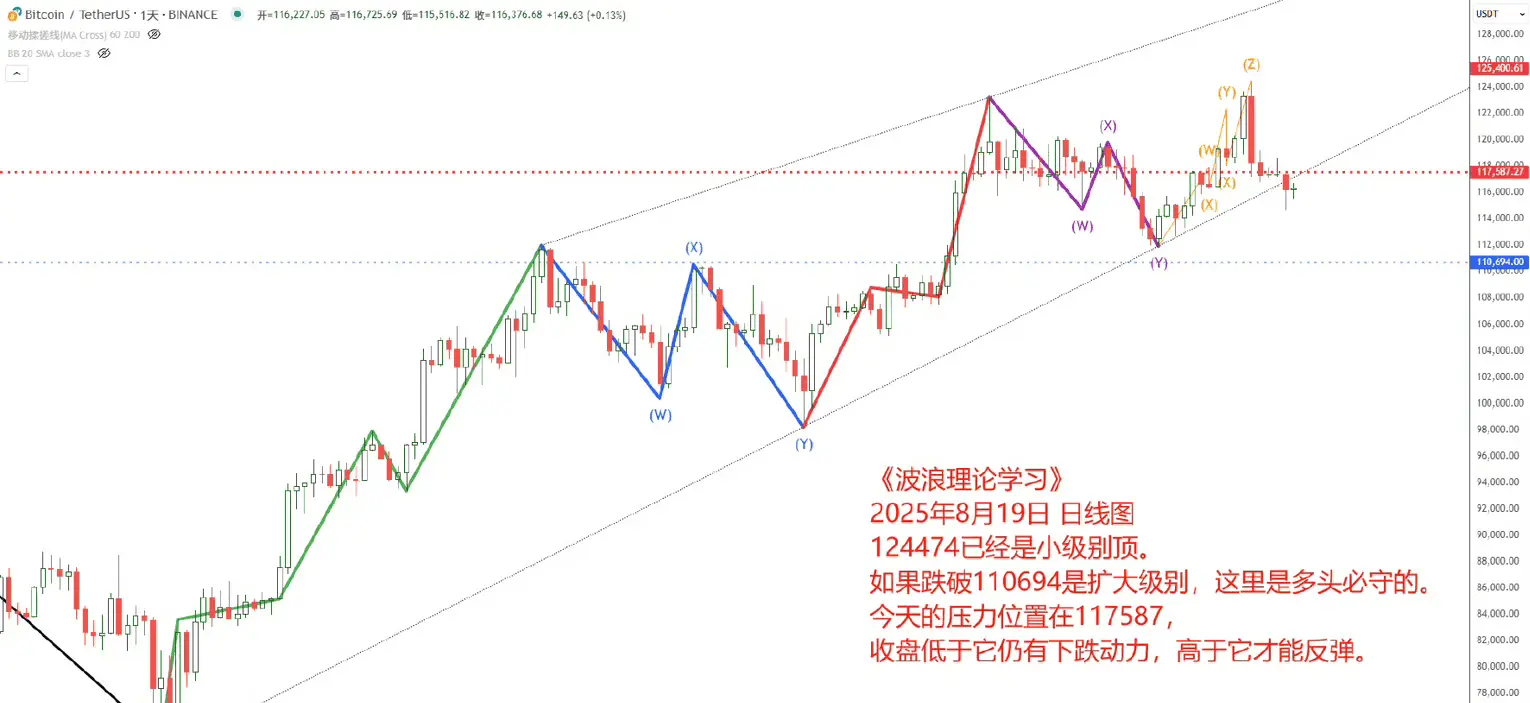

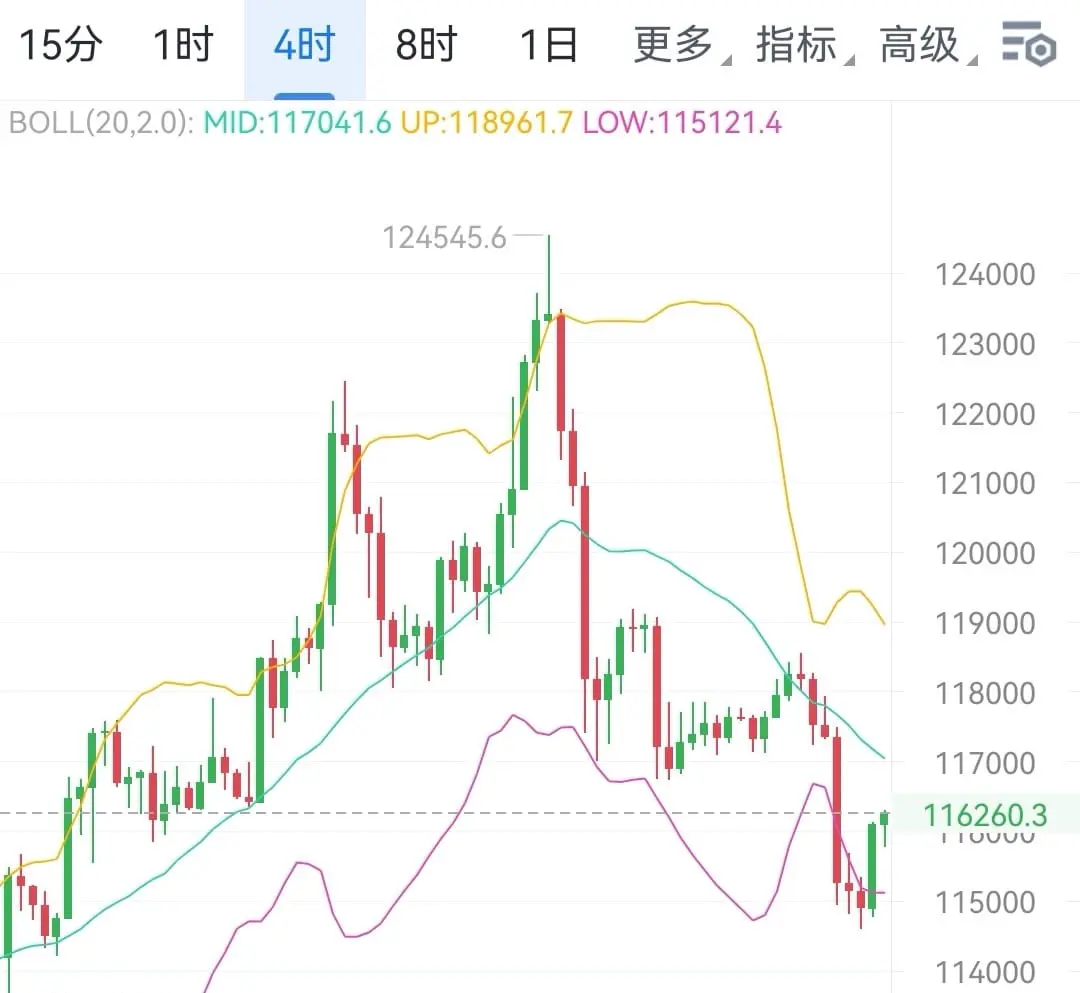

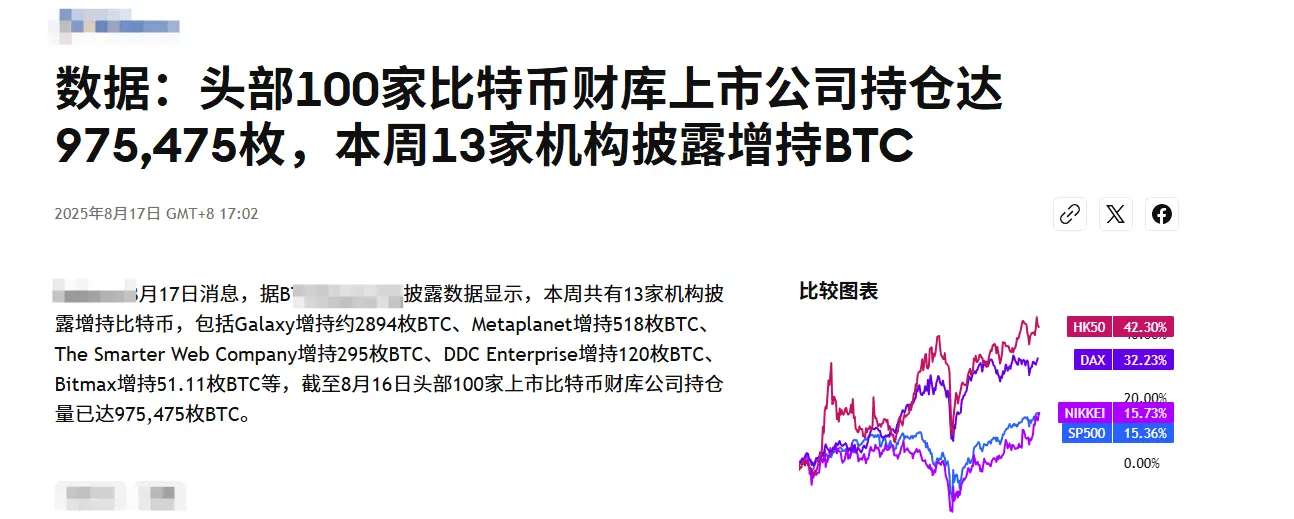

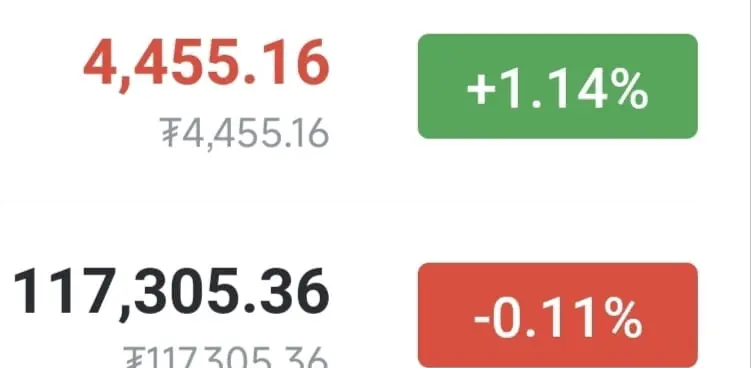

At the beginning of this week, the Crypto Assets market showed a fall, with major digital assets generally experiencing losses. In the past 24 hours, the market has continued to trade sideways, with Bitcoin prices hovering around $115,000.

Ethereum, as the second largest crypto asset by market capitalization, has also failed to break through the $4,300 mark and currently faces the possibility of a drop to the $4,100 range. The recently impressive Stellar (XLM) has not been spared from this round of adjustments.

Despite positive news from the Stellar ecosystem, the performance of XLM remains we

View OriginalEthereum, as the second largest crypto asset by market capitalization, has also failed to break through the $4,300 mark and currently faces the possibility of a drop to the $4,100 range. The recently impressive Stellar (XLM) has not been spared from this round of adjustments.

Despite positive news from the Stellar ecosystem, the performance of XLM remains we